Given the recent market slide and volatility, we thought it prudent to pass along a few Informative pieces that you may want to review to give a perspective on the current Market situation.

1. Emotional Investing:

Discusses how markets bounce back and why investors may not want to sit on the sidelines

When something is threatening us, experience tells us to get away as quickly as possible. That’s a prudent reaction when dealing with bears, avalanches and hurricanes, but it’s not so helpful when it comes to investing.

Markets Bounce Back

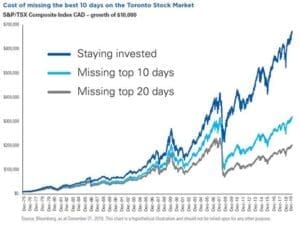

- When markets drop, our first instinct may be to sell immediately. But that’s often the worst thing to do.

- In fact, by the time we’re feeling that urge to sell, it’s probably already too late to limit the damage. And the period right after a market drop is often the most profitable. This is when portfolio managers typically buy more of the stocks they believe in, because those stocks are now bargains.

- And when the market recovers, it’s often in vigorous fashion, as the chart below shows.

S&P/TSX Composite Index total return 12 months after markets hit bottom has been back up an average of 33%.

By selling when your investments are dropping, you’re locking in a loss and missing the possible run up to pre-decline or higher prices.

2. The Bulls Outweigh the Bears:

2. The Bulls Outweigh the Bears:

shows why investors should stay invested for the long term

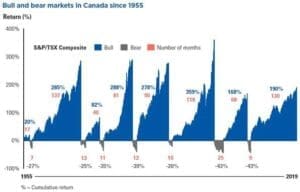

- No one enjoys a bear market – usually defined as a market decline of 20% or more over two months.

- But looking back through the history of both the Canadian and U.S. stock markets, it’s clear that on average, bull markets – an increase of 50% or more in the value of the stock market – last longer and more than make up for losses incurred during bear markets.

- This is one more reason to focus on the long term and stay invested – even when the markets are going through a rough patch.

Average Bear Market Duration is 12 months, Average Bear Market return is – 33%

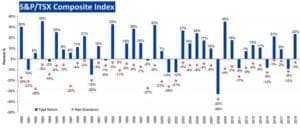

Compares max draw down (negative return) by calendar year vs. return for the year. The chart shows the yearly trough is lower than the return for the year which provides rational for staying invested.

Source: Morningstar Direct Dec. 31, 2019

Source: Morningstar Direct Dec. 31, 2019

Should you have any questions or comments please don’t hesitate to reach out to our office, we are here to serve you.

Kind Regards,

Paul Rowan

President, Chief Executive Officer

Chairman of Investment Committee